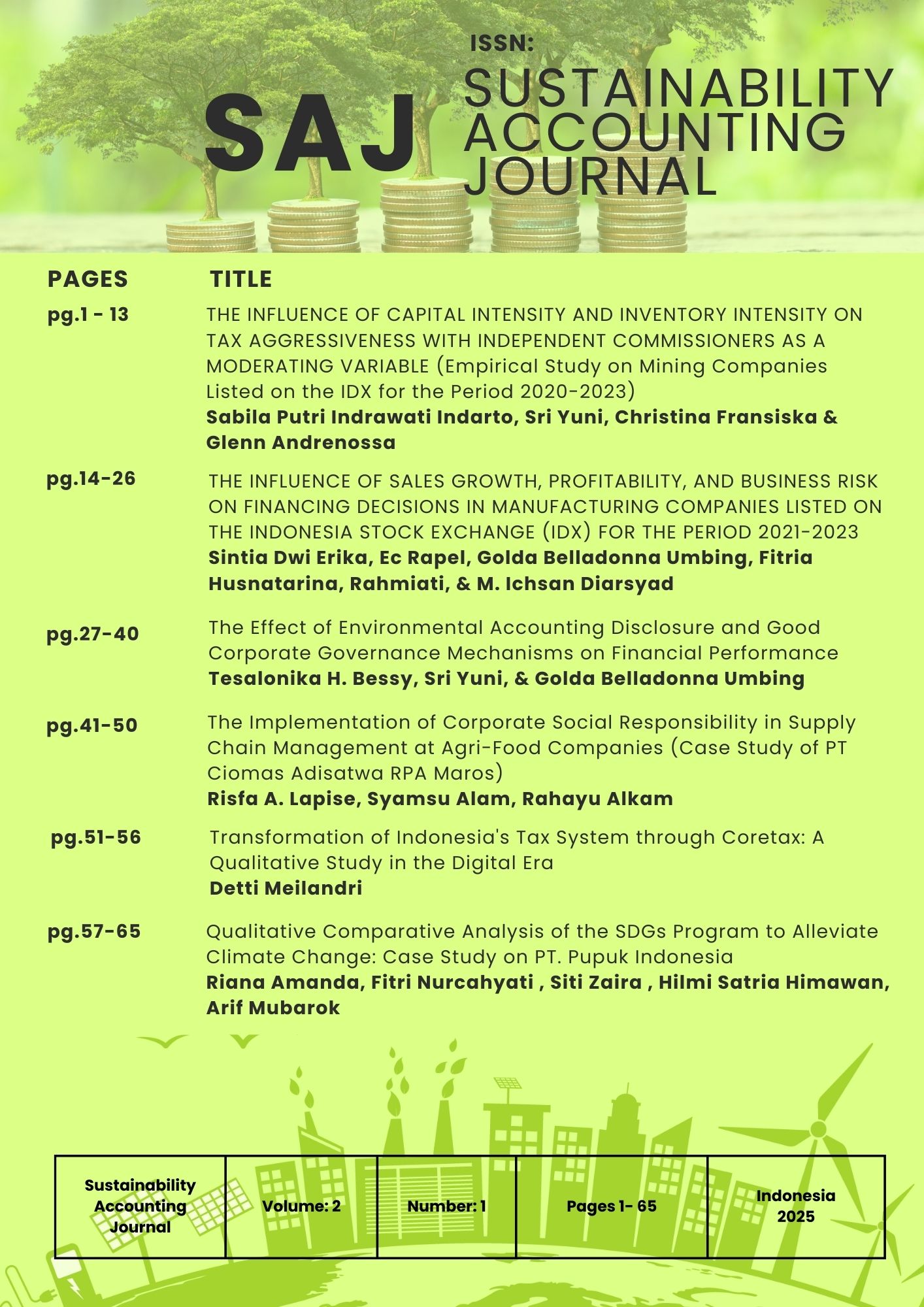

The Influence Of Capital Intensity And Inventory Intensity On Tax Aggressiveness With Independent Commissioners As A Moderating Variable (Empirical Study On Mining Companies Listed On The Idx For The Period 2020-2023)

Keywords:

Capital Intensity, Inventory Intensity, Independent Commissioner, Tax AggressivenessAbstract

This study aims to determine the effect of capital intensity and inventory intensity on tax aggressiveness and the effect of independent commissioners in moderating the effect of independent variables on dependent variables in mining companies listed on the IDX for the 2020-2023 period. This study uses a quantitative research type using secondary data from company annual reports. The research sample used was mining companies listed on the IDX for the 2020-2023, totaling 40 companies. Determination of the number of samples using the purposive sampling method. The data analysis techniques used were multiple linear regression analysis and moderation regression analysis processed using the SPSS version 25 application. This study's results indicate that capital and inventory intensity have a positive and significant effect on tax aggressiveness. Meanwhile, independent commissioners cannot moderate the effect of capital intensity, and inventory intensity has a positive and significant effect on tax aggressiveness. Further researchers should add other variables that can affect a company's tax aggressiveness. In addition, banking companies should pay attention to their tax planning actions because they can affect shareholder assessments.