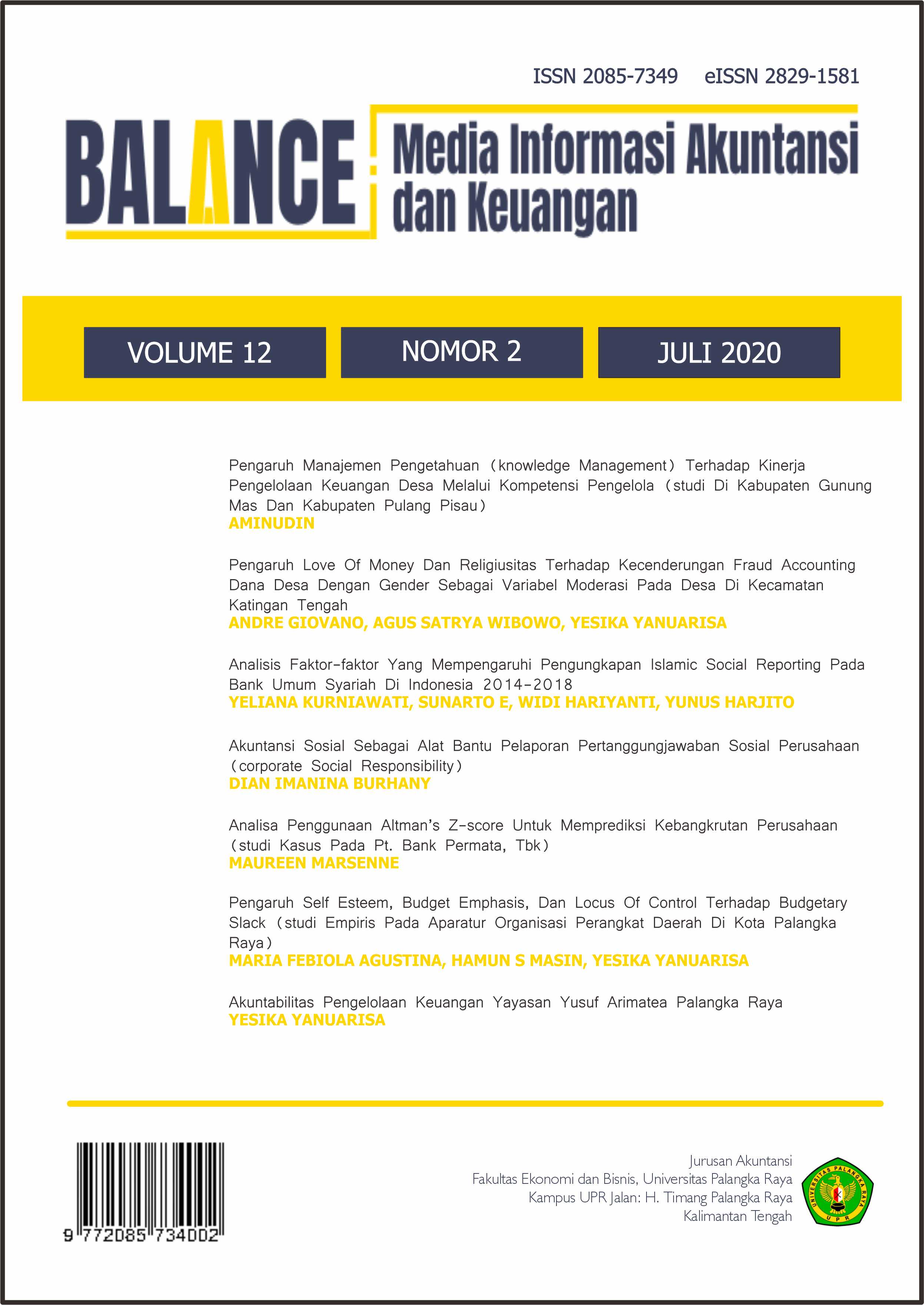

ANALISA PENGGUNAAN ALTMAN’S Z-SCORE UNTUK MEMPREDIKSI KEBANGKRUTAN PERUSAHAAN (STUDI KASUS PADA PT. BANK PERMATA, Tbk)

DOI:

https://doi.org/10.52300/blnc.v12i2.1884Keywords:

ALTMAN’S Z-SCORE, Kebangkrutan PerusahaanAbstract

Altman set thresholds for measurement with the Z Score, all companies those with a Z Score greater than 2.99 are classified as non-bankrupt companies. Companies that have a Z score between 2.7 to 2.99 show little indication problem (though not serious). Companies that have a Z Score between 1.8 to 2.69 gives an indication if the company does not make radical improvements, the company may experience the threat of bankruptcy within two years and, Z Score below 1.8 shows an indication that the company is facing the threat of bankruptcy seriously and investors and creditors should be careful in making investments. Although the results shown show the value described, there is the limitations of Altman's Model Z Score so that it can be used more further in Indonesian banking it is necessary to make adjustments to the constants used for each variable so that it can be more precisely used to predict bank bankruptcy in Indonesia.