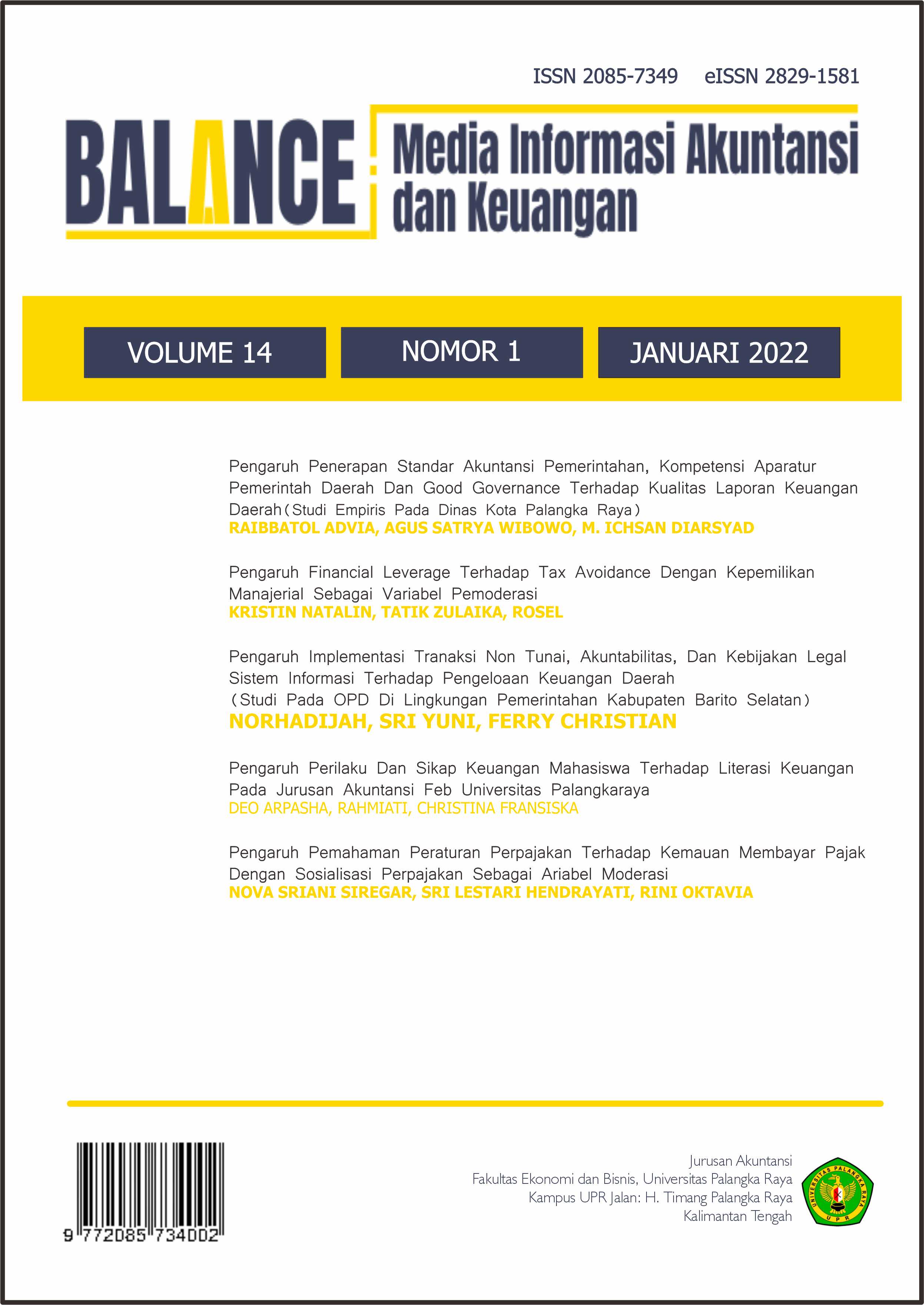

PENGARUH PERILAKU DAN SIKAP KEUANGAN MAHASISWA TERHADAP LITERASI KEUANGAN PADA JURUSAN AKUNTANSI FEB UNIVERSITAS PALANGKARAYA

DOI:

https://doi.org/10.52300/blnc.v14i1.8555Keywords:

student financial behavior, attitudes, financial literacyAbstract

The role of student financial behavior and attitudes is important in implementing wise financial literacy. This study aims to determine the behavior and financial attitudes of students towards financial literacy using quantitative methods. The data obtained primary with the questionnaire data collection method and the intended respondents are accounting students in semesters 4 (2020/2021) FEB Palangkaraya University. Sampling was carried out using the Slovin formula and purposive sampling technique so as to get 68 students as samples. The analytical method used is multiple linear regression and the measurement scale of the sample questionnaire value uses a Likert scale. Based on the results of partial and simultaneous regression testing, it is known that student financial behavior has no effect on student financial literacy. Students' financial attitudes have a significant effect on financial literacy. Financial attitudes are needed so that financial literacy is getting better in order to face increasingly complex financial problems in the future. From this study also, students' financial behavior and attitudes have a simultaneous effect on financial literacy, this shows financial behavior followed by the way students respond to the resources they have, leading to a wise attitude in implementing their financial literacy

Downloads

References

Ananingtiyas, H. (2016). Pengaruh Faktor Demografi dan Sikap Pengelolaan Keuangan Keluarga pada Perencanaan Pensiun Keluarga di Gresik dan Surabaya.

Boon, T. H., Yee, H. S., & Ting, H. W. (2011). Financial Literacy and Personal Financial Planning in Klang Valley, Malaysia. International Journal of Economics and Management.

Busyro, W. (2019). Pengaruh Literasi Keuangan Terhadap Perilaku Pengelolaan Keuangan Mahasiswa (Studi Kasus Pada Mahasiswa Fakultas Ekonomi Dan Bisnis Universitas Muhammadiyah Riau).

Chen, H., & Volpe, R. p. (1998). An Analysis of Personal Financial Literacy Among College Students. Journal of Financial Services Review.

Chinen, Kenichiro, & Hideki, Endo, 2012. Effect of Attitude and Bacground on Personal Finance Ability: A Student survey in the United State, International Journal of Management.

Danang, Sunyoto. 2012. Manajemen Sumber Daya Manusia. Jakarta: PT Buku Seru.http://repository.upi.edu/17628/4/S_MBS_1001311_Bibliography

Dew, J., & Xiao, J. J. (2011). The Financial Management Behavior Scale: Development and Validation. Journal of Financial Counseling and Planning.

Direktorat Literasi dan Edukasi Keuangan. Mahasiswa Universitas Hamzanwadi dan Faktor-Faktor Yang Mempengaruhinya.

Fakultas Ekonomika dan Bisnis Universitas Diponegoro angkatan 2014- 2017, Jurnal Dinamika Ekonomi Pembangunan.

Fuller, R.J. (2000). Behaviral Finance and the Source of Alpha. Journal of Pension Plan Investing.

Gahagho, Y. D., Rotinsulu, T. O., dan Mandeij, D. (2021). Pengaruh Literasi Keuangan, Sikap Keuangan Dan Sumber Pendapatan Terhadap Perilaku Pengelolaan Keuangan Mahasiswa Fakultas Ekonomi Dan Bisnis Unsrat Dengan Niat Sebagai Variabel Intervening.

Ghozali, Imam. (2007). Aplikasi Analisis Multivariate dengan Program SPSS). Badan Penerbit Universitas Diponegoro, Semarang.

Herdjiono, I, & Damanik, L. A. (2016). Pengaruh Financial Attitude , Financial Knowledge, Parental Income Terhadap Financial Management. Jurnal Manajemen Teori Dan Terapan.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin. studies, 14(3), 659-680. https://doi.org/10.1093/rfs/14.3.659.

https://www.academia.edu/6887073/Personal_Financial_Literacy_Among_University_Students_Case_Study_at_Padjadjaran_University_Students_Bandung_ Indonesa. Keluarga Tentang Pengeluaran Uang Saku: Ditinjau dari Perbedaan Gender.

Huston, S.J. 2010. Measuring Financial Literacy. The Journal of Consumer Affairs.

Ida dan Dwinta. (2010). Pengaruh Locus Of Control, Financial Knowledge, Income terhadap Financial Management Behavior. Jurnal Bisnis Akuntansi. http://www.stietrisakti.ac.id/jba/JBA12.3Desember2010/1_artikel_JBA12.3Desember2010.pdf.

Keuangan Para Pengguna Kartu Kredit di Indonesia. Jurnal Akuntansi dan Investasi Volume 16 Nomor 2

Kurniawan, C. (2017). Analisis Faktor-Faktor yang Mempengaruhi Perilaku Konsumtif Ekonomi pada Mahasiswa. Jurnal Media Wahana Ekonomika.

Laily, N. (2016). Pengaruh Literasi Keuangan Terhadap Perilaku Mahasiswa Dalam Mengelola Keuangan. Journal of Accounting and Business Education.

Listiani, Kurnia. (2017). Pengaruh Financial Knowledge, Locus of Control dan Financial Attitude Terhadap Financial Management Behavior Mahasiswa.

Lusardi, A. (2012). Numeracy, financial literacy, and financial decision-making (No.17821). National burcau of economic research.

Margaretha, F., & May Sari, S. (2015). Faktor Penentu Tingkat Literasi Keuangan Para Pengguna Kartu Kredit di Indonesia. Jurnal Akuntansi Dan Investasi. https://doi.org/10.18196/jai.2015.0038.132-144

Marsh, B. A. (2006). Examining The Personal Finance Attitudes, Behaviors, and Knowledgw Levels First-Year and Senior Students at Baptist Universities in The State of Texas.

Mien, N. T. N., & Thao, T. P. (2015). Factors Affecting Personal Financial Management Behaviors : Evidence from Vietnam. Proceedings of the Second Asia-Pacific Conference on Global Business, Economics, Finance and Social Sciences.

Nidar, S. R., & Bestari, S. (2012). Personal literacy among university students (case study at Padjajaran University students, Bandung, Indonesia. World Journal of Social Sciences.

Nofsinger, J. R. (2001). The Impact of Public Information on Investors. Journal of Banking & Finance. https://doi.org/10.1016/S0378-266(00)00133-3.

Nofsinger, John R. (2001). Investment Madness: How Psychology Affects Your Investing and what to do about it: Prentice Hall.

Nurjanah, S., Ilma, R. Z., & Suparno, S. (2018). Effect of Economic Literacy and Conformity on Student Consumptive Behaviour. Dinamika Pendidikan, 13(2), 198–207. https://doi.org/10.15294/dp.v13i2.18330

OECD INFE. (2012). High-Level Principles on National Strategies for Financial Education. Paris : OECD.

Otoritas Jasa Keuangan. (2016). Edukasi dan Perlindungan Konsumen. Web site: http://www.ojk.go.id/id/kanal/edukasi-dan perlindungankonsumen/pages/literasi-keuangan.asp

Otoritas Jasa Keuangan. (2017). Strategi Nasional Literasi Keuangan Indonesia.

Pankow, D. (2013). Financial Values, Attitude and Goals. Web site: http://www.ag.ndsu.edu/pubs/yf/fammgmt/fs591.pdf.

Pribadi. Nominal, Barometer Riset Akuntansi Dan Manajemen, 6(1). https://doi.org/10.21831/nominal.v6i1.14330

Qamar, M. A. J., Khemta, M. A. N., dan Jamil, H. (2016). How Knowledge and Financial Self-Efficacy Moderate the Relationship between Money Attitudes and Personal Financial Management Behavior. European Online Journal of Natural and Social Sciences.

Rustiaria, A. P. (2017). Pengaruh pengetahuan keuangan, sikap keuangan, dan tingkat pendidikan terhadap perilaku pengelolaan keuangan keluarga. Journal of Business and Banking.

Sabri, M. F., Cook, C. C., & Gudmunson, C. G. (2012). Financial well-being of Malaysian college students Asian Education and Development Studies Emerald Article : Financial well-being of Malaysian college students. 1(2), 153–170. https://doi.org/10.1108/20463161211240124

Sarwono, S. (2017). Pengantar Psikologi Umum. Jakarta: Rajawali Pers.

Selcuk, E. A. (2015). Factors Influencing College Students’ Financial Behaviors in Turkey: Evidence from a National Survey. International Journal of Economics and Finance. 7(6), 87–94. https://doi.org/10.5539/ijef.v7n6p87

Shefrin, H. (2000). Beyond greed and fear: Understanding behavioral finance and psychology of investing, Harvard Business School Press.

Shefrin, Hersh. 2005. A Behavioral Approach for Asset Pricing. Elseiver Academic Press.

Shockey, S. S. (2002). Low-wealth adult’s financial literacy. Money management behavior and associates factors, including critical thinking. Unpublished doctoral dissertation, The Ohio State University (AAT 3039524).

Siahaan, M. D. R. (2013). Pengaruh Literasi Keuangan Terhadap Perilaku Pengelolaan Keuangan Pada Mahasiswa Perguruan Tinggi Di Surabaya. Journal of Business and Banking. Cetakan ke-1. Depok: Rajawali.

Sugiyono 2013. Metode Penelitian (Pendekatan Kuantitatif, Kuantitatif Dan R&D). Alfabeta. Bandung.

Suryanto. (2017). Pola Perilaku Keuangan Mahasiswa Di Perguruan Tinggi. Jurnal Ilmu Politik Dan Komunikasi.

Susanti, Ari., Ismuawan., Pardi., dan Ardyan, Elia. (2017). Tingkat Pendidikan, Literasi Keuangan, Dan Perencanaan Terhadap Perilaku Keuangan UMKM Di Surakarta.

Widayati, irin. 2012. Faktor-Faktor yang Mempengaruhi Literasi Finansial Mahasiswa Fakultas Ekonomi dan Bisnis Universitas Brawijaya. ASSET: Jurnal Akuntansi dan Pendidikan.

Yap, R. J. C., Komalasari, F., dan Hadiansah, I. (2016). The Effect of Financial Literacy and Attitude on Financial Management Behavior and Satisfaction. Journal of Administrative Science and Organization.

Yuningsih, Irma., Dewi, Andriesta Sinta dan Gustyana, Tieka Trikartika. (2017). Analisis Tingkat Literasi Keuangan Masyarakat Di Kota Bandung. Jurnal Neraca.