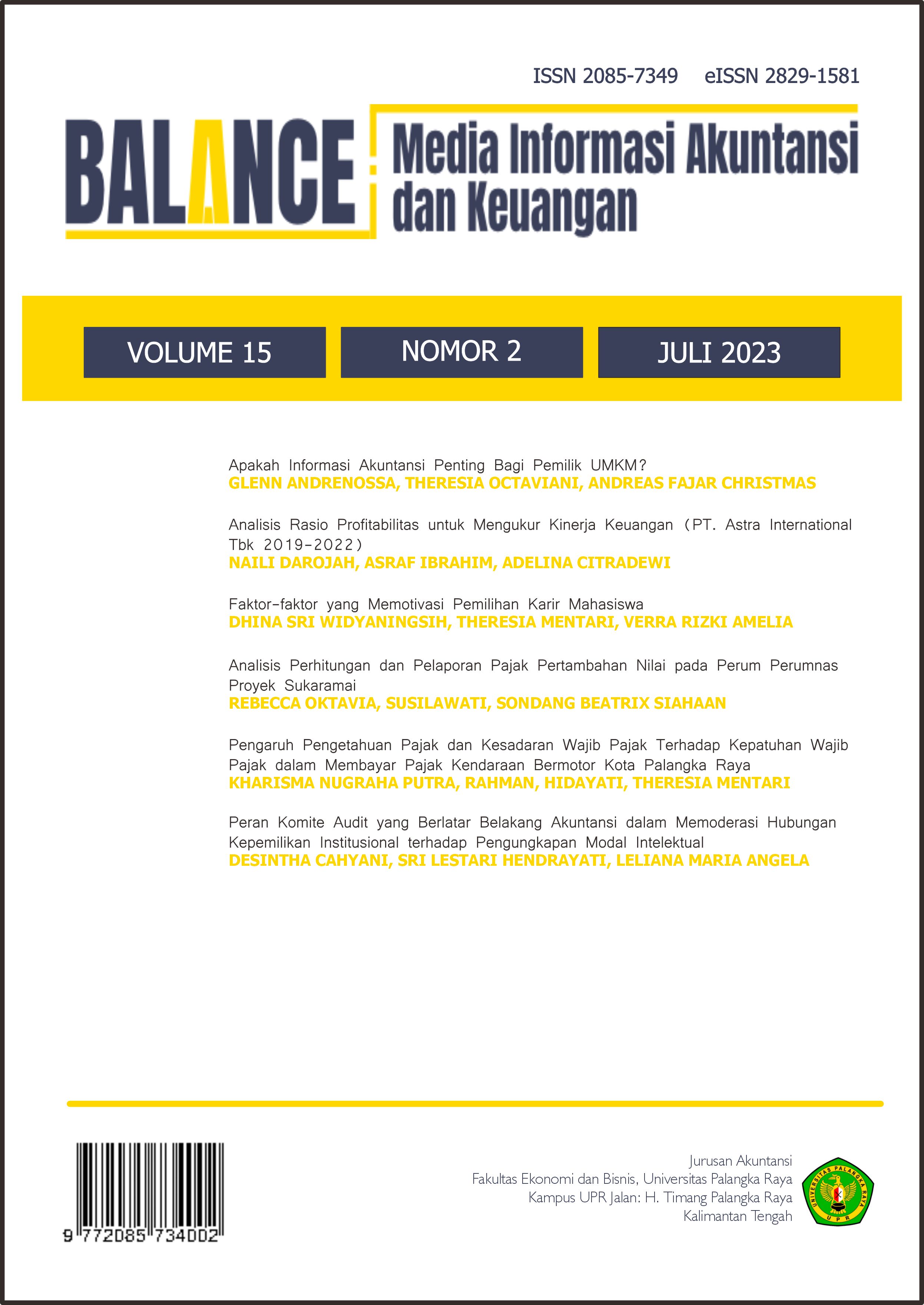

Analisis Rasio Profitabilitas untuk Mengukur Kinerja Keuangan (PT. Astra International Tbk 2019-2022)

DOI:

https://doi.org/10.52300/blnc.v15i2.9698Keywords:

Financial Performance, Profitability RatioAbstract

One of the leading industrial companies in automotive manufacturing is PT Astra International Tbk, which is also listed on the Indonesia Stock Exchange. The purpose of this study is to find out how to measure profitability using ROE, ROA, NPM, and GPM ratios for PT. Astra International Tbk in 2019–2022. The study in question uses descriptive quantitative methods, which involve analyzing company employee data, and a special type of study using time series data from 2020-2022 financial forecasts. The results of the analysis show that financial work is based on profitability; this shows ROE, ROA, and NPM are consistently increasing year after year and at a higher rate than the industry. This shows that there is a good financial job. GPM will fluctuate between 2020 and 2021, and there will be another increase in the following year, 2022.

Downloads

References

Afriyeni, Afriyeni, and Jhon Fernos. 2018. “Analisis Faktor-Faktor Penentu Kinerja Profitabilitas Bank Perkreditan Rakyat (Bpr) Konvensional Di Sumatera Barat.” Jurnal Benefita 3(3):325–35. doi: 10.22216/jbe.v3i3.3623.

Aini, Nur, Hasanuddin Hasanuddin, and Mulyana Machmud. 2022. “Analisis Rasio Profitabilitas Dan Aktivitas.” Amsir Management Journal 3(1):29–41. doi: 10.56341/amj.v3i1.128.

Aldrian, Paseki, Wilfried S. Manoppo, and Joanne V. Mangindaan. 2021. “Analisis Laporan Keuangan Untuk Mengukur Kinerja Keuangan PT Hasjrat Abadi Manado.” Productivity 2(1):52–57.

Asirah, Andi, and A. Ratna Sari. 2022. “Analisis Rasio Likuiditas Dan Rasio Profitabilitas Pada PT XXYZ Di Makassar.” Jurnal Manajemen Dan Bisnis 1(1):180–94. doi: 10.36490/jmdb.v1i1.348.

Atul, Umma Nafi, Yuwita Nur Inda Sari, and Yuyun Juwita Lestari. 2022. “Analisis Rasio Keuangan Untuk Mengukur Kinerja Keuangan Perusahaan.” E-Jurnal Akuntansi TSM 2(3):89–96. doi: 10.34208/ejatsm.v2i3.1396.

Bintari, Vivi Indah, and Deasy Lestary Kusnandar. 2021. “Perbandingan Abnormal Return Saham Sebelum Dan Sesudah Perubahan Waktu Perdagangan Selama Pandemi Covid-19.” Jurnal Manajemen, Bisnis Dan Organisasi (Jumbo) 5(3):439–44. doi: 10.33772/jumbo.v5i3.21441.

Cahya, Agus Dwi, Heditri Rachmawati, and Rista Ridhowasti. 2021. “Analisis Kesehatan Keuangan Perusahaan Di Masa Pandemi Covid 19 Menggunakan Rasio Likuiditas, Profitabilitas Dan Solvabilitas (Studi Kasus Umkm Ameera Hijab).” Equilibrium 10(2):131–36. doi: 10.35906/je001.v10i2.788.

Febriyanti, Galuh Artika. 2020. “Dampak Pandemi Covid-19 Terhadap Harga Saham Dan Aktivitas Volume Perdagangan (Studi Kasus Saham LQ-45 Di Bursa Efek Indonesia).” Indonesia Accounting Journal 2(2):204–14. doi: 10.32400/iaj.30579.

Fernos, Jhon. 2017. “Analisis Rasio Profitabilitas Untuk Mengukur Kinerja PT. Bank Pembangunan Daerah Provinsi Sumatera Barat.” Jurnal Pundi 1(2):107–18. doi: 10.31575/jp.v1i2.25.

Firdaus, Firdaus, Saifullah Saifullah, Nurul Huda, and Idad Firhan. 2021. “Analisis Rasio Profitabilitas Pada PT. Bank Muamalat Tbk Tahun Periode 2015-2019.” Jurnal Proaksi 8(1):113–23. doi: 10.32534/jpk.v8i1.1675.

Harahap, Lily Rahmawati, Rani Anggraini, and R. Y. Effendy. 2021. “Analisis Rasio Keuangan Terhadap Kinerja Perusahaan PT Eastparc Hotel, Tbk (Masa Awal Pandemi Covid-19).” Competitive Jurnal Akuntansi Dan Keuangan 5(1):57–63. doi: 10.31000/competitive.v5i1.4050.

Kominfo.go.id. 2020. “Kebijakan Work From Home Secara Penuh Di Kantor Pusat Kementrian Kominfo.” Retrieved (https://www.kominfo.go.id/content/detail/35132/siaran-pers-no-214hmkominfo062021-tentang-kebijakan-work-from-home-secara-penuh-di-kantor-pusat-kementriankominfo/0/siaran_pers.).

Nisa, Thoyibatun. 2020. “Analisis Rasio Keuangan Pada Perusahaan Sektor Pertambangan Yang Terdaftar Di BEI 2016-2019.” Finansia 03(01):63–74. doi: 10.32332/finansia.v3i1.2183.

Riyadi, Syamsul, and Rustan Rustan. 2018. “Analisis Resiko Keuangan Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia.” Jurnal Sinar Manajemen 5(2):74–81. doi: 10.56338/jsm.v5i2.288.

Safitri, Rosi Aidila, Sheilla Merliana Widya Susanti, and Sukma Laili Surya Puspita Zulfatunisa. 2022. “Analisis Laporan Keuangan Untuk Mengukur Kinerja Kuangan PT Astra Internasional Tbk.” Istithmar: Jurnal Studi Ekonomi Syariah 6(2):137–45. doi: 10.30762/istithmar.v6i1.33.

Sari, Yulia Permata, and Doni Marlius. 2019. “Analisis Rasio Profitabilitas Pada PT. Bank Negara Indonesia Syariah.” 1–11. doi: 10.31219/osf.io/94bwq.

Sukmawati, Vita Diah, Hanik Soviana, Bheta Ariyantina, and Adelina Citradewi. 2022. “Kinerja Keuangan Ditinjau Dari Analisis Rasio Profitabilitas (Studi Pada PT Erajaya Swasembada Periode 2018-2021).” Jurnal Ilmiah Akuntansi Dan Bisnis 7(2):189–206. doi: 10.38043/jiab.v7i2.3692.

Syafii, Muhamad, Wa Ariadi, and Ahadi Rerung. 2022. “Analisis Rasio Profitabilitas Dalam Mengukur Pertumbuhan Laba Usaha PT. Astra International Tbk.” Jurnal Ekonomi Dan Bisnis 14(2):45–57. doi: 10.55049/jeb.v14i2.119.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Balance: Media Informasi Akuntansi dan Keuangan

This work is licensed under a Creative Commons Attribution 4.0 International License.